Creditor Alert: Federal Judge Grants Injunction to Temporarily Block Law Slashing Judgment Interest Rate on Consumer Debts

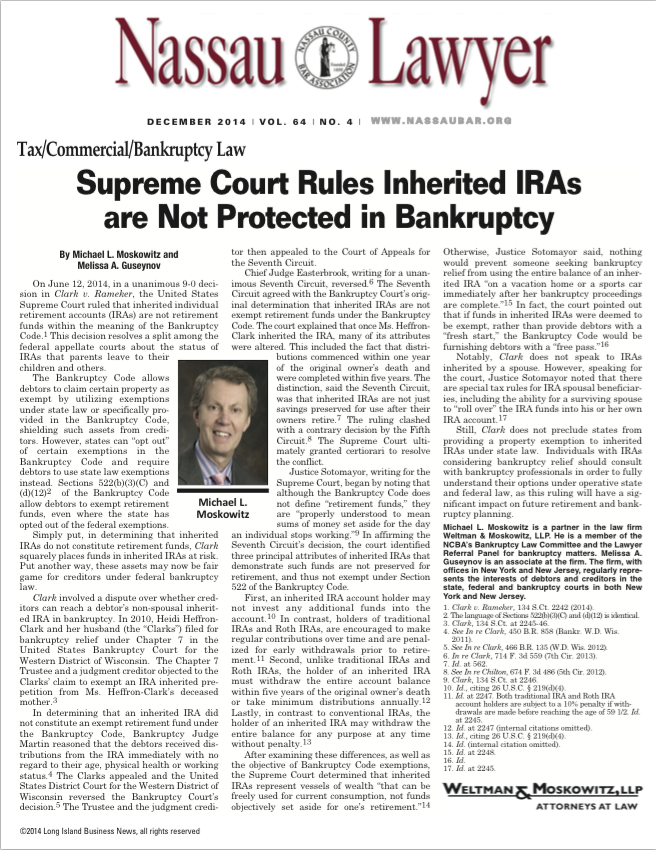

By: Michael L. Moskowitz and Melissa A. Guseynov

We previously reported on the Consumer Judgment Interest Act (S.5724A/A.6474A), enacted on December 31, 2021, which retroactively lowered the post-judgment interest rate from 9 percent to 2 percent. (See here: Consumer Alert: Judgment Interest on Consumer Debt Slashed by Governor Hochul). The reduction would sharply reduce the debt load for consumers who are unable to pay their debts before a judgment is entered.

We previously reported on the Consumer Judgment Interest Act (S.5724A/A.6474A), enacted on December 31, 2021, which retroactively lowered the post-judgment interest rate from 9 percent to 2 percent. (See here: Consumer Alert: Judgment Interest on Consumer Debt Slashed by Governor Hochul). The reduction would sharply reduce the debt load for consumers who are unable to pay their debts before a judgment is entered.

On December 31, 2021, Governor Kathy Hochul signed the Consumer Judgment Interest Act (S.5724A/A.6474A) to protect New Yorkers from the excessive interest rate applied to money judgments arising out of consumer debt, including credit card, medical and student debt, by lowering the post-judgment interest rate from 9 per cent to 2 percent.

On December 31, 2021, Governor Kathy Hochul signed the Consumer Judgment Interest Act (S.5724A/A.6474A) to protect New Yorkers from the excessive interest rate applied to money judgments arising out of consumer debt, including credit card, medical and student debt, by lowering the post-judgment interest rate from 9 per cent to 2 percent. In a memorandum opinion, dated February 28, 2022, United States Bankruptcy Judge Robert E. Grossman stated he will no longer entertain motions for loss mitigation in chapter 7 or 13 cases assigned to him. He explained the loss mitigation program was implemented in 2009 as a temporary administrative process due to the collapse of the mortgage industry and was never intended to become a “de facto right or a new form of bankruptcy protection.” Thus, while debtors and secured creditors may reach a consensual mortgage modification, it will be on a voluntary basis only and not court-sanctioned, as nothing in the Bankruptcy Code allows a Bankruptcy Court to “forcibly restructure a residential mortgage.”

In a memorandum opinion, dated February 28, 2022, United States Bankruptcy Judge Robert E. Grossman stated he will no longer entertain motions for loss mitigation in chapter 7 or 13 cases assigned to him. He explained the loss mitigation program was implemented in 2009 as a temporary administrative process due to the collapse of the mortgage industry and was never intended to become a “de facto right or a new form of bankruptcy protection.” Thus, while debtors and secured creditors may reach a consensual mortgage modification, it will be on a voluntary basis only and not court-sanctioned, as nothing in the Bankruptcy Code allows a Bankruptcy Court to “forcibly restructure a residential mortgage.” As practitioners are aware, notarization is required for numerous sworn statements and affidavits. This typically requires the person executing the document to physically appear before a notary public. However, with the onset of the Covid-19 pandemic, New York allowed remote notarization to take place on a limited and temporary basis. However, on December 22, 2021, Governor Kathy Hochul signed into law Senate Bill 1780C, which permanently provides for electronic notarization with the use of video technology, subject to certain restrictions. The law, which takes effect on June 20, 2022, aligns New York with a majority of states that permit remote notarization.

As practitioners are aware, notarization is required for numerous sworn statements and affidavits. This typically requires the person executing the document to physically appear before a notary public. However, with the onset of the Covid-19 pandemic, New York allowed remote notarization to take place on a limited and temporary basis. However, on December 22, 2021, Governor Kathy Hochul signed into law Senate Bill 1780C, which permanently provides for electronic notarization with the use of video technology, subject to certain restrictions. The law, which takes effect on June 20, 2022, aligns New York with a majority of states that permit remote notarization.  Governor Kathy Hochul allowed the moratorium on COVID-related residential and commercial evictions and foreclosures for New York State to expire on January 15, 2022, noting it was never intended to be permanent. The statewide moratorium was extended several times since it was first passed in the early days of the pandemic. For now, tenants can still file for eviction protection and rent relief with the state Office of Temporary Disability Assistance.

Governor Kathy Hochul allowed the moratorium on COVID-related residential and commercial evictions and foreclosures for New York State to expire on January 15, 2022, noting it was never intended to be permanent. The statewide moratorium was extended several times since it was first passed in the early days of the pandemic. For now, tenants can still file for eviction protection and rent relief with the state Office of Temporary Disability Assistance. On August 12, 2021, the U.S. Supreme Court granted a request from a group of New York landlords to block a part of the state's eviction moratorium, enacted due to the COVID-19 pandemic. Landlords claimed they did not have a way to challenge tenants who sought protection from eviction by submitting a hardship claim form which tenants were allowed to complete citing they experienced economic hardship because of the pandemic. Property owners argued that tenants could use the hardship claims to avoid paying rent even when they have the ability to do so.

On August 12, 2021, the U.S. Supreme Court granted a request from a group of New York landlords to block a part of the state's eviction moratorium, enacted due to the COVID-19 pandemic. Landlords claimed they did not have a way to challenge tenants who sought protection from eviction by submitting a hardship claim form which tenants were allowed to complete citing they experienced economic hardship because of the pandemic. Property owners argued that tenants could use the hardship claims to avoid paying rent even when they have the ability to do so.

We have reported extensively over the years regarding the judicial treatment of student loans in bankruptcy, particularly with respect to how federal courts have interpreted section 523(a)(8) of the Bankruptcy Code, which bars a debtor from discharging certain student loan debt. See 11 U.S.C. § 523(a)(8). However, in a recent decision issued by the Court of Appeals for the Second Circuit, the court held that private student loan debt is indeed dischargeable in bankruptcy. In re Hilal K. Homaidan, Case No. 20-1981 (2d. Cir. July 15, 2021). Read the full opinion

We have reported extensively over the years regarding the judicial treatment of student loans in bankruptcy, particularly with respect to how federal courts have interpreted section 523(a)(8) of the Bankruptcy Code, which bars a debtor from discharging certain student loan debt. See 11 U.S.C. § 523(a)(8). However, in a recent decision issued by the Court of Appeals for the Second Circuit, the court held that private student loan debt is indeed dischargeable in bankruptcy. In re Hilal K. Homaidan, Case No. 20-1981 (2d. Cir. July 15, 2021). Read the full opinion

On May 25, 2021, the New York Senate passed Bill S153 (“Bill”), called the “Consumer Credit Fairness Act,” which: (i) establishes a 3-year statute of limitations for commencement of a cause of action arising out of a consumer credit transaction; (ii) sets forth a required notice of lawsuit that must be mailed to a defendant; (iii) establishes certain requirements for a complaint, including but not limited to attaching a copy of the contract or instrument to the complaint; and (iv) provides for arbitration of such actions. The Bill was passed in the Assembly on June 2, 2021, and will now be sent to the Governor’s desk for signature or veto.

On May 25, 2021, the New York Senate passed Bill S153 (“Bill”), called the “Consumer Credit Fairness Act,” which: (i) establishes a 3-year statute of limitations for commencement of a cause of action arising out of a consumer credit transaction; (ii) sets forth a required notice of lawsuit that must be mailed to a defendant; (iii) establishes certain requirements for a complaint, including but not limited to attaching a copy of the contract or instrument to the complaint; and (iv) provides for arbitration of such actions. The Bill was passed in the Assembly on June 2, 2021, and will now be sent to the Governor’s desk for signature or veto. We have previously written about the strict requirements of the requisite notice which must be sent to a borrower before commencement of a residential foreclosure action in New York. New York’s Real Property Actions and Proceedings Law (“RPAPL”) § 1304 requires a mortgage lender to notify a residential home borrower of an impending foreclosure action at least 90 days before the foreclosure action is commenced, using specific statutory language, printed in 14-point type, sent by registered or certified mail, as well as by first class mail, to the borrower (“RPAPL 1304 NOTICE”). The statute does not specifically address whether lender’s counsel may send the RPAPL 1304 NOTICE on behalf of its client.

We have previously written about the strict requirements of the requisite notice which must be sent to a borrower before commencement of a residential foreclosure action in New York. New York’s Real Property Actions and Proceedings Law (“RPAPL”) § 1304 requires a mortgage lender to notify a residential home borrower of an impending foreclosure action at least 90 days before the foreclosure action is commenced, using specific statutory language, printed in 14-point type, sent by registered or certified mail, as well as by first class mail, to the borrower (“RPAPL 1304 NOTICE”). The statute does not specifically address whether lender’s counsel may send the RPAPL 1304 NOTICE on behalf of its client.  A new rule proposed by the Consumer Financial Protection Bureau (“CFPB”), would create a new pre-eviction review period to grant millions of Americans more time to figure out payment options before Covid-19 federal mortgage protections expire at the end of June. A copy of the proposal can be found

A new rule proposed by the Consumer Financial Protection Bureau (“CFPB”), would create a new pre-eviction review period to grant millions of Americans more time to figure out payment options before Covid-19 federal mortgage protections expire at the end of June. A copy of the proposal can be found  In a recent opinion of interest to creditors and debtors alike, on January 14, 2021, the Supreme Court held that passive retention of a debtor’s property does not violate the automatic stay. City of Chicago v. Fulton, Case No. 19-357 (Sup. Ct. Jan. 14, 2021). Read the full opinion

In a recent opinion of interest to creditors and debtors alike, on January 14, 2021, the Supreme Court held that passive retention of a debtor’s property does not violate the automatic stay. City of Chicago v. Fulton, Case No. 19-357 (Sup. Ct. Jan. 14, 2021). Read the full opinion  The Court of Appeals for the Second Circuit recently upheld the lower courts’ decisions holding that a debtor’s non-primary residence qualified for the federal “homestead” exemption under section 522(d)(1) of the Bankruptcy Code. In re Maresca, Case No. 19-3331 (2d. Cir. Dec. 14, 2020). Read the full opinion

The Court of Appeals for the Second Circuit recently upheld the lower courts’ decisions holding that a debtor’s non-primary residence qualified for the federal “homestead” exemption under section 522(d)(1) of the Bankruptcy Code. In re Maresca, Case No. 19-3331 (2d. Cir. Dec. 14, 2020). Read the full opinion  Creditors having significant claims against a bankruptcy debtor often face daunting challenges. Many general practitioners are simply not familiar enough with bankruptcy procedures. Liquidation and reorganization cases have materially different objectives, proceedings move quickly, claims deadlines are strictly observed, and bankruptcy statutes and rules typically favor debtors over creditors. When matrimonial disputes are added to the mix, the bankruptcy court is charged with balancing public policy—protecting the child and custodial parent and deferring to state family court expertise—with the interests of a financially troubled debtor seeking a fresh start. Despite the initial disadvantage, Creditor preparation, diligence and expert help can turn things around.

Creditors having significant claims against a bankruptcy debtor often face daunting challenges. Many general practitioners are simply not familiar enough with bankruptcy procedures. Liquidation and reorganization cases have materially different objectives, proceedings move quickly, claims deadlines are strictly observed, and bankruptcy statutes and rules typically favor debtors over creditors. When matrimonial disputes are added to the mix, the bankruptcy court is charged with balancing public policy—protecting the child and custodial parent and deferring to state family court expertise—with the interests of a financially troubled debtor seeking a fresh start. Despite the initial disadvantage, Creditor preparation, diligence and expert help can turn things around. In a recent opinion of interest, the Bankruptcy Court for the District of New Mexico held that a federal credit union constitutes an “instrumentality of the United States” as included in the definition of “governmental unit” pursuant to section 101(27) of the Bankruptcy Code. In re Marquez, Case No. 19-10284-j7 (Bankr. D. N.M. Sept. 30, 2020). Read the full opinion

In a recent opinion of interest, the Bankruptcy Court for the District of New Mexico held that a federal credit union constitutes an “instrumentality of the United States” as included in the definition of “governmental unit” pursuant to section 101(27) of the Bankruptcy Code. In re Marquez, Case No. 19-10284-j7 (Bankr. D. N.M. Sept. 30, 2020). Read the full opinion  On December 1, 2020, several amendments to the Federal Rules of Bankruptcy Procedure took effect. These amendments largely modify rules governing bankruptcy appeals, but also importantly impact Rules 2002 and 2004. Some court filing fees also increased slightly.

On December 1, 2020, several amendments to the Federal Rules of Bankruptcy Procedure took effect. These amendments largely modify rules governing bankruptcy appeals, but also importantly impact Rules 2002 and 2004. Some court filing fees also increased slightly.  A Houston Bankruptcy Judge’s recent decision brings into question the need for – and efficacy of – the longstanding Jay Alix Protocol. In re McDermott Int’l Inc., 20-30336 (Bankr. S.D. Tex. May 20, 2020).

A Houston Bankruptcy Judge’s recent decision brings into question the need for – and efficacy of – the longstanding Jay Alix Protocol. In re McDermott Int’l Inc., 20-30336 (Bankr. S.D. Tex. May 20, 2020).  In a recent opinion of note, the Bankruptcy Court for the Eastern District of California sided with the majority of courts in holding section 362(c)(3)(A) of the Bankruptcy Code does not apply to property of a debtor’s estate. In re Thu Thi Dao, Case No. 20-20742 (Bankr. E.D. Cal. May 11, 2020). Read the full opinion

In a recent opinion of note, the Bankruptcy Court for the Eastern District of California sided with the majority of courts in holding section 362(c)(3)(A) of the Bankruptcy Code does not apply to property of a debtor’s estate. In re Thu Thi Dao, Case No. 20-20742 (Bankr. E.D. Cal. May 11, 2020). Read the full opinion  Weltman & Moskowitz, LLP was retained by one of the few remaining dairies located in New York State to file a chapter 11 bankruptcy petition (“Debtor” or “Client”). Due to a downturn in the industry, Client was forced to close its doors after more than 150 years of operating its family-owned business. While production and other operating costs had steadily increased, sales had significantly decreased leaving the business unprofitable. When the bankruptcy was filed, it was anticipated the business would be sold to a previously-located purchaser (“Purchaser”) with whom Client had been negotiating for several months. Unfortunately, as Client’s business continued to lose customers and profitability fell, the Client was forced to renegotiate the sale price to an exponentially lower number and, ultimately, the Purchaser withdrew its offer entirely. As a result, the client was obliged to liquidate its few hard assets (the client’s business value was primarily tied to business relationships) and collect accounts receivable with a new goal of filing a liquidating plan under chapter 11.

Weltman & Moskowitz, LLP was retained by one of the few remaining dairies located in New York State to file a chapter 11 bankruptcy petition (“Debtor” or “Client”). Due to a downturn in the industry, Client was forced to close its doors after more than 150 years of operating its family-owned business. While production and other operating costs had steadily increased, sales had significantly decreased leaving the business unprofitable. When the bankruptcy was filed, it was anticipated the business would be sold to a previously-located purchaser (“Purchaser”) with whom Client had been negotiating for several months. Unfortunately, as Client’s business continued to lose customers and profitability fell, the Client was forced to renegotiate the sale price to an exponentially lower number and, ultimately, the Purchaser withdrew its offer entirely. As a result, the client was obliged to liquidate its few hard assets (the client’s business value was primarily tied to business relationships) and collect accounts receivable with a new goal of filing a liquidating plan under chapter 11. n a recent opinion of significance, the Bankruptcy Court for the Eastern District of New York held that a court cannot legitimize a void foreclosure sale with a nunc pro tunc order. In re David Telles, Case No. 20-70325 (Bankr. E.D.N.Y. April 30, 2020). Read the full opinion

n a recent opinion of significance, the Bankruptcy Court for the Eastern District of New York held that a court cannot legitimize a void foreclosure sale with a nunc pro tunc order. In re David Telles, Case No. 20-70325 (Bankr. E.D.N.Y. April 30, 2020). Read the full opinion  We have previously reported on the judicial treatment of student loan dischargeability in bankruptcy. To this end, we have analyzed how federal courts have interpreted section 523(a)(8) of the Bankruptcy Code, which prohibits bankruptcy courts from discharging most student loan debt “unless excepting such debt from discharge under this paragraph would impose an undue hardship on the debtor and the debtor’s dependents.” 11 U.S.C. § 523(a)(8). In a recent decision from the Southern District of New York Bankruptcy Court, Chief Judge Cecilia Morris analyzed the treatment of student loan debt in bankruptcy under the “undue hardship” exception of section 523(a)(8) of the Bankruptcy Code. Chief Judge Morris determined that, based on the Brunner test, a debtor with a gross annual income of $37,500 could discharge over $220,000 of student loan debt. In re Rosenberg, Case No. 18-09023 (Bankr. S.D.N.Y. Jan. 7, 2020). Read the full opinion

We have previously reported on the judicial treatment of student loan dischargeability in bankruptcy. To this end, we have analyzed how federal courts have interpreted section 523(a)(8) of the Bankruptcy Code, which prohibits bankruptcy courts from discharging most student loan debt “unless excepting such debt from discharge under this paragraph would impose an undue hardship on the debtor and the debtor’s dependents.” 11 U.S.C. § 523(a)(8). In a recent decision from the Southern District of New York Bankruptcy Court, Chief Judge Cecilia Morris analyzed the treatment of student loan debt in bankruptcy under the “undue hardship” exception of section 523(a)(8) of the Bankruptcy Code. Chief Judge Morris determined that, based on the Brunner test, a debtor with a gross annual income of $37,500 could discharge over $220,000 of student loan debt. In re Rosenberg, Case No. 18-09023 (Bankr. S.D.N.Y. Jan. 7, 2020). Read the full opinion  Whether a mortgagee has standing to foreclose on a home loan is a frequently litigated issue in mortgage foreclosure actions in New York. Simply put, a mortgage lender has standing to foreclose on a promissory note if it is the holder of the note at issue at the time the foreclosure action is commenced. As is set forth in more detail below, a recently enacted law in New York provides that the defense of “lack of standing” in a foreclosure action is not waived if the defendant fails to raise the defense at the start of the litigation, thus introducing a new level of uncertainty in foreclosures and possibly prolonging an already lengthy, and costly, procedure for lenders.

Whether a mortgagee has standing to foreclose on a home loan is a frequently litigated issue in mortgage foreclosure actions in New York. Simply put, a mortgage lender has standing to foreclose on a promissory note if it is the holder of the note at issue at the time the foreclosure action is commenced. As is set forth in more detail below, a recently enacted law in New York provides that the defense of “lack of standing” in a foreclosure action is not waived if the defendant fails to raise the defense at the start of the litigation, thus introducing a new level of uncertainty in foreclosures and possibly prolonging an already lengthy, and costly, procedure for lenders.  By: Michael L.

By: Michael L. In a recent opinion, the Bankruptcy Court for the Northern District of New York ordered the reduction of post-petition attorney’s fees payable to a lender by nearly half.

In a recent opinion, the Bankruptcy Court for the Northern District of New York ordered the reduction of post-petition attorney’s fees payable to a lender by nearly half.

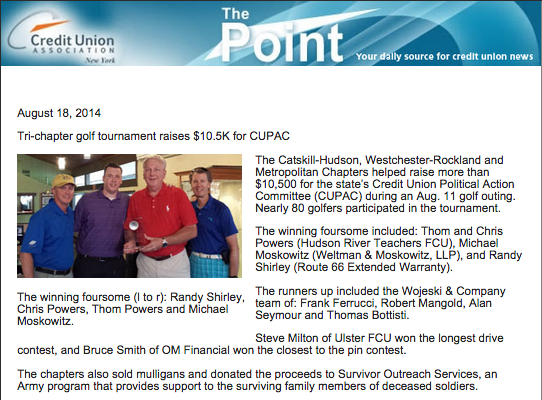

Founding partners Richard E. Weltman and Michael L. Moskowitz are pleased to announce that effective May 15, 2017, the attorneys at Weltman & Moskowitz, LLP have become Counsel to the Chicago-based Chuhak & Tecson, P.C. law firm. This alliance allows both firms to develop new relationships and to expand Chuhak & Tecson’s presence in New York and New Jersey. Both firms remain independent.

Founding partners Richard E. Weltman and Michael L. Moskowitz are pleased to announce that effective May 15, 2017, the attorneys at Weltman & Moskowitz, LLP have become Counsel to the Chicago-based Chuhak & Tecson, P.C. law firm. This alliance allows both firms to develop new relationships and to expand Chuhak & Tecson’s presence in New York and New Jersey. Both firms remain independent.

By Michael L. Moskowitz and Melissa A. Guseynov

By Michael L. Moskowitz and Melissa A. Guseynov

On March 11, 2016, the Court of Appeals for the Seventh Circuit held that a tenant debtor’s pre-petition lease termination may be voidable as a fraudulent conveyance or a preferential transfer in the tenant’s subsequent bankruptcy case. In re Great Lakes Quick Lube LP, 816 F.3d 482 (7th Cir. 2016).

On March 11, 2016, the Court of Appeals for the Seventh Circuit held that a tenant debtor’s pre-petition lease termination may be voidable as a fraudulent conveyance or a preferential transfer in the tenant’s subsequent bankruptcy case. In re Great Lakes Quick Lube LP, 816 F.3d 482 (7th Cir. 2016).

New York’s Real Property Actions and Proceedings Law (“RPAPL”) § 1304 requires a mortgage lender to notify a residential home borrower of an impending foreclosure action at least 90 days before the foreclosure action is commenced, using specific statutory language, printed in 14 point type, sent by registered or certified mail, as well as by first class mail, to the borrower. The emphasis of this article is the peril which will befall a lender if it fails to timely register the statutorily mandated notice.

New York’s Real Property Actions and Proceedings Law (“RPAPL”) § 1304 requires a mortgage lender to notify a residential home borrower of an impending foreclosure action at least 90 days before the foreclosure action is commenced, using specific statutory language, printed in 14 point type, sent by registered or certified mail, as well as by first class mail, to the borrower. The emphasis of this article is the peril which will befall a lender if it fails to timely register the statutorily mandated notice.

The United States Supreme Court recently denied a creditor’s petition for certiorari in an Eleventh Circuit case entitled Bank of America, N.A. v. David Lamar Sinkfield (No. 13-700). The issue concerns whether section 506(d) of the Bankruptcy Code allows a debtor to remove or strip-off a wholly unsecured—or “underwater”—mortgage lien in chapter 7 bankruptcy.

The United States Supreme Court recently denied a creditor’s petition for certiorari in an Eleventh Circuit case entitled Bank of America, N.A. v. David Lamar Sinkfield (No. 13-700). The issue concerns whether section 506(d) of the Bankruptcy Code allows a debtor to remove or strip-off a wholly unsecured—or “underwater”—mortgage lien in chapter 7 bankruptcy.